While I’ve spent the past year exploring midlife reinvention in broad strokes, I’m now narrowing in on personal finance especially for Gen Xers: what’s happening in the economy, how to make sense of it, and what we can do to protect and grow our money at a time when we may be considering retirement or looking for a new career.

I’m a failed buy-and-hold investor, and that means I’ve underperformed everyone for the past ten or fifteen years. Why didn’t it work for me? Because I’m human, and I am easily panicked by stock market gyrations, especially in the brokerage account where I have my non-retirement savings. It’s been easy for me to set and forget my retirement portfolio, less easy with money that I may or may not want to tap into soon.1

I suffer from the “buy high and sell low” phenomenon. My confidence increases as stock prices go up, and I become more willing to buy at higher prices. “What, Bitcoin is at $100K? I’m in!” Meanwhile, I get antsy if stock prices go down, and after some time, I sell, but not according to any systematic rules. Not having a good way to know when to get back in, I hang back too long. The cycle repeats, and I’m left wondering why I’m so incredibly bad at this.

Should I figure out how to make buy-and-hold work for me? I don’t think so. I think we’re entering an era where market timing will beat buy-and-hold. And anyway, my psychology just isn’t suited for it. I like a more active approach, one that lets me ride waves of outperformance in different asset classes depending on the current macroeconomic environment.

In this article, I’ll share with you the reasons why buy-and-hold may not perform as well as it has for the last fifteen years, and one alternative strategy you might follow.

the end of buy-and-hold?

Buy and hold, especially if you chose the S&P 500 as your major or only portfolio allocation, has been a winning strategy since the Great Financial Crisis.

However, there are good reasons to expect that the coming ten years will not be like the last 15, and a simplistic buy-and-hold the S&P 500 strategy could will almost certainly fail to reliably return the 10+% that investors have become accustomed to.

The most obvious reason for questioning buy-and-hold U.S. stocks is the global instability ushered in by a U.S. presidential administration enchanted with isolationist, mercantilist policies. This administration came to power because of underlying economic weakness, so I am not saying Trump is an uncaused cause in this shift. Pax Americana’s exceptionalism and success was built on an extremely large and growing government deficit, interest rates held too low for too long, and an economy that rewards the few instead of the many. To my mind, Trump is a symptom of an empire reaching its twilight, living off incredible debt that has become unsustainable. Global instability, both political and economic, increases the chances of sudden market shocks such as we saw on Liberation Day. It puts buy-and-hold investors at risk of heavy losses if they don’t develop and follow strategies to protect against severe losses.2

Meanwhile, non-U.S. stocks could continue the outperformance they’ve already shown in 2025. They appear undervalued for no other reason than pro-U.S. equity, anti-non-U.S. equity sentiment around the world which is rapidly disappearing. Capital flight out of an increasingly untrustworthy U.S. could hasten this value normalization.

Plus, alternatives to fiat currencies may outperform as governments, businesses, and individuals seek haven from inflation and alternatives to the U.S. dollar. There are good reasons to believe that gold and Bitcoin will do well, but they are so volatile that using a buy-and-hold approach may not work for many weak-stomached investors like myself.

Let’s not forget the graying of the developed world. Aging populations in developed countries especially the U.S., Europe, and China may create persistent headwinds for equity markets. Fewer workers and more retirees wil mean slower growth, lower consumption, and increased pressure on government budgets. A grayer world may not deliver the same reliable equity returns we saw from the 1980s to the 2010s.

Finally, buy and hold works best when you start from cheap prices, but that’s not today’s setup at all, especially in that darling of buy-and-hold investors, the S&P 500. U.S. stocks, particularly mega-caps, remain historically expensive by many valuation measures such as the Shiller PE or the price-to-sales ratios. High starting valuations tend to predict lower future returns.

I could go on. There are plenty of other reasons to look for alternatives to buy-and-hold the S&P 500 as your default investment strategy.3 Of course, for me, it never worked anyway!

how about some market timing?

Is there a market timing approach I could use to benefit from my eagerness to buy strength and sell weakness?4 And to take advantage of the coming wave of global instability and change I see on the horizon?

Why, yes, in fact, there is: a simple market timing model suggested by Cambria’s Meb Faber in which you only buy and stay invested when an asset class is within 5% of its all-time high (or, more realistically for investors living in the now, within 5% of its trailing twelve-month high).

For details, check out my post about Faber’s all-time-high market timing model.

Last week, I suggested that investors should be looking at gold as an important part of their portfolios. The gold price had just reached an all-time high last week and amost immediately technical analysts declared it had reached a top. It struggled last week mostly. Was I leading you astray by suggesting you should buy at all time highs? Was I leading myself astray?

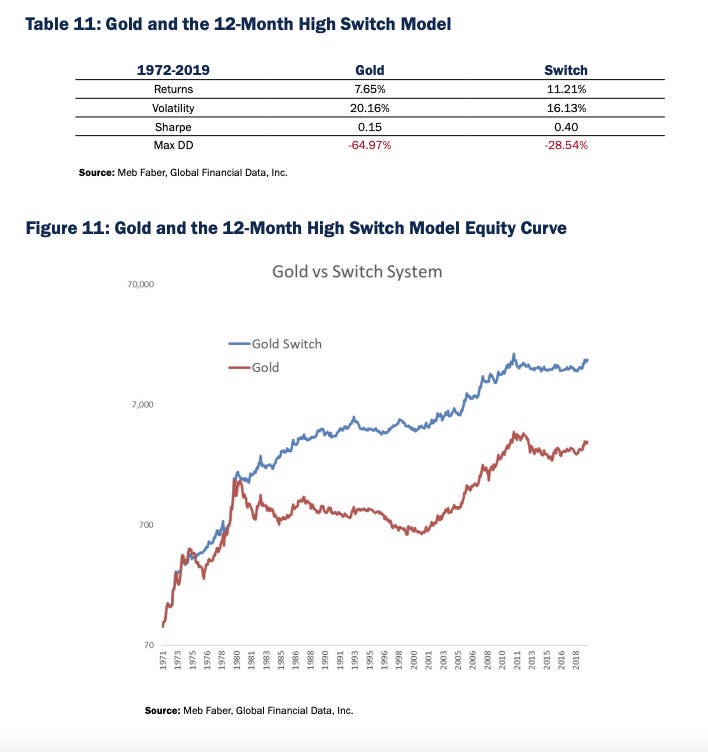

Faber shows that buying gold at all-time highs, so long as you sell when it starts to decline, offers superior returns to buy-and-hold returns:

Like any backtest of an investment strategy this doesn’t tell you how you will do if you, in fact, buy gold right now, when it is within 5% of its all-time high and has been reaching new highs since late 2022 — that was the time to get in, wasn’t it? The backtest assumes you’d been doing this already, starting whenever it first reached a new trailing twelve-month high. But you have to start sometime. It could be that you get in now, gold continues to decline versus drive higher, and you end up selling in a month or two, with only a loss to show for it. Then once it once again reached an all-time (or trailing twelve-month) high you’d buy into strength.

my plans

I’m planning to use some version of Faber’s trailing-twelve-month high switch model going forward. I was already doing some market timing loosely based on another strategy he’s promoted in which you get in and out based on short-term moving averages crossing longer-term moving averages. In terms of my psychology, either approach suits me well. They are more active than buy-and-hold but far more systematic than simply choosing my investing stance and allocations based on vibes. When I rely on my own decisions about buying and selling, I wait too long to buy and to sell. These timing models will help me do it in a reliable, algorithmic fashion to override my human tendencies.

I’m curious to hear from you. Are you a buy-and-hold investor? Do you think that global political and economic changes might make you look for alternatives? Where are you putting your savings right now?

Anne Zelenka is a Gen X data scientist, artist, and writer who shares her observations on living successfully at midlife here and in other places around the web. You can follow her on Twitter or on Bluesky, check out her yearlong reinvention blogging at The Reinvention Project, or visit her website, currently focused on her abstract art but could change any time!

Also, I went through many life changes that left my financial situation in upheaval. It’s hard to practice a strategy that requires consistency for five or ten years when every one or two years your brokerage account balance looks vastly different.

In his April 2025 comment, market observer John Hussman noted that during the dotcom bust, the technology-heavy Nasdaq 100 index lost 83% from its March 2000 peak. The S&P 500 lost almost 50%. Few seem to think right now that we could face similar losses in the next few years. But it is a possibility, and it is something that Gen X investors preparing for retirement should be ready for.

There are, also, plenty of reasons you might argue buy-and-hold is the right strategy to take: American innovation will likely continue driving growth especially with AI possibilities taking off, you can easily globally diversify with the right low-cost ETFs, “time in the market beats timing the market,” and so forth. I am continuing a mostly buy-and-hold approach for my diversified retirement portfolio. And I would recommend this to my twenty-something children who can look forward to decades of returns and plenty of time to recover from losses before they retire.

A topic for another article: Why are individual investors endlessly lectured to "buy and hold," when the world's most successful investors — Warren Buffett (who dumps stocks when fundamentals change), Stanley Druckenmiller (who times macro shifts for a living), and George Soros (who famously broke the Bank of England) — clearly don't sit passively through every storm? Maybe "buy and hold" is advice meant to protect Wall Street’s business model, not your portfolio.